Did you know that over 50% of joint ventures fail within three years ? This fact shows how complex these partnerships can be. Two or more companies work together to share resources and skills for a common goal1. Today, companies are turning to joint ventures to save money and reach new markets. In fact, 40% of US CEOs plan to form new partnerships to increase profits soon2.

Learning about joint ventures means understanding how they work together, manage risks, and keep their own identities. Successful examples like Hulu, Vevo, and United Launch Alliance show what can be achieved through teamwork. But, forming a joint venture comes with big challenges. It’s important to plan well to overcome these issues.

- Joint ventures involve two or more businesses collaborating under a contractual agreement.

- Companies in a joint venture share profits and risks as outlined in their initial contracts.

- Over 50% of joint ventures terminate within three years, highlighting their challenging nature.

- 40% of CEOs are looking to pursue new joint ventures to drive growth and profitability.

- Effective communication and trust are critical factors for the success of a joint venture.

What is a Joint Venture?

A joint venture is when two or more businesses work together to reach certain goals. They share their resources and make decisions together. This way, they can work more efficiently and come up with new ideas.

Definition and Concepts

The joint venture definition is about short-term partnerships for a shared goal. It’s different from regular partnerships because it creates a new entity. It’s crucial to have a detailed contract that covers everything from rights to profits and losses3.

Joint ventures help businesses enter new markets with less risk. They use local knowledge to their advantage3. Clear contracts are key to making sure everyone works well together4.

Characteristics of Joint Ventures

Joint ventures let businesses try new things without taking on all the costs and risks alone3. They share decision-making, which means giving up some control3. Often, they have a 50:50 partnership to ensure everyone has an equal say in managing the venture5.

Joint ventures usually end when their goals are reached or when they want to go in a different direction5. They can be set up in different ways, like through companies or contracts, giving businesses flexibility4.

Benefits of Establishing a Joint Venture

Starting a joint venture has many perks. It lets businesses use the benefits of joint venture structures. By working together, companies can share costs and grow bigger. This teamwork helps manage risks better, making it easier to grow.

Shared Resources and Risk Management

One big reason to start a joint venture is to share resources. Each company puts in some money and know-how, easing the financial load. Joint ventures spread out the risk, making them less likely to fail due to market changes or unexpected problems6.

This way, businesses can grow safely, especially when they need to enter the market fast and save money7.

Access to New Markets and Skills

Joint ventures open doors to new markets and offer support from local partners6. They let companies use new skills and ideas, keeping them ahead in the game. Getting access to special knowledge also helps small companies look more credible, by working with well-known brands7.

A recent survey found that 58% of top executives think joint ventures are better than traditional mergers today8.

Flexibility Compared to Mergers

Joint ventures are more flexible than mergers, letting companies keep their own identity. They offer a way to control daily tasks while still working together. This flexibility is key in today’s fast-changing market, helping companies stay ahead and grow without the big challenges of merging6.

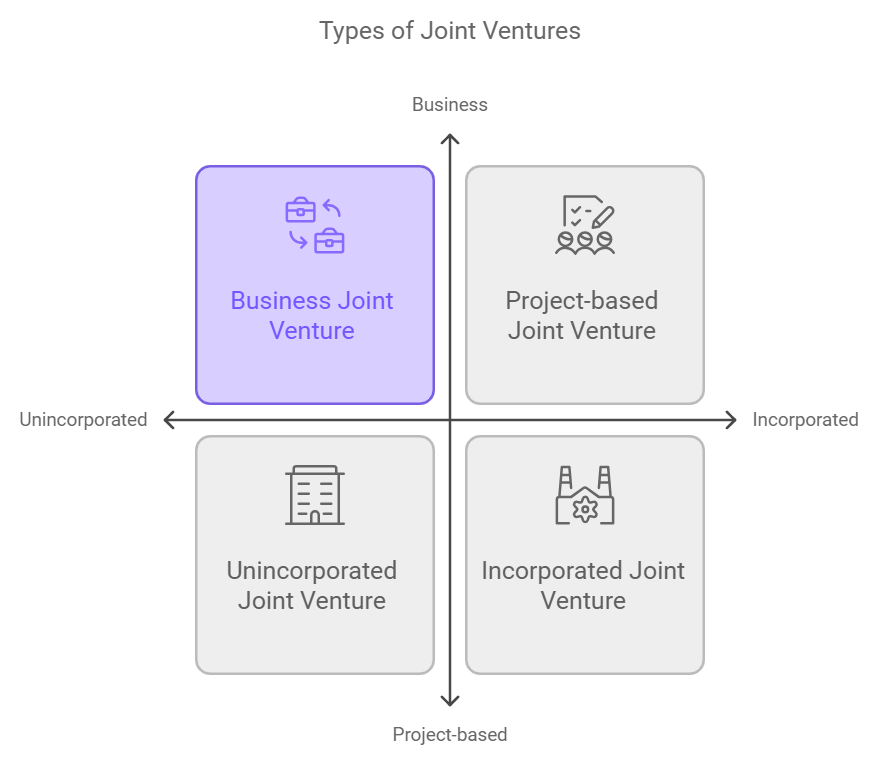

Types of Joint Ventures

It’s key for businesses to know the different kinds of joint ventures. They can be either business joint ventures or project-based joint ventures. Each type has its own purpose. There’s also a big difference between unincorporated and incorporated joint ventures, which affects how they work.

Business Joint Ventures

Business joint ventures mean companies work together for a long time. They use their resources together for big projects. This can make things cheaper and give them more power to buy things9. For example, Starbucks and PepsiCo have worked together since 1994 on making coffee drinks9.

Project-based Joint Ventures

Project-based joint ventures focus on a specific project with clear goals. They help companies share the risks of new projects. For instance, BP and Reliance Industries put $20 billion into an offshore oil project in India in 20119. These partnerships usually end when the project is done9.

Unincorporated vs. Incorporated Joint Ventures

Joint ventures can be either unincorporated or incorporated, which changes how they work. Unincorporated ones work like partnerships but don’t create a new legal entity. Incorporated ones make a new company or LLP10. This choice is important because it affects how risks are handled and resources are shared.

| Type of Joint Venture | Description | Example |

|---|---|---|

| Business Joint Venture | Ongoing collaboration with shared resources | Starbucks and PepsiCo’s North American Coffee Partnership |

| Project-based Joint Venture | Time-bound collaboration focused on a specific project | BP and Reliance Industries’ $20 billion offshore project |

| Unincorporated Joint Venture | Partnerships without separate legal status | Strategic alliances and informal partnerships |

| Incorporated Joint Venture | Formation of a new legal entity | Company or LLP structures in joint ventures |

Each type of joint venture has its own goals and affects how companies work together11. They offer both benefits and challenges for the partners.

How Joint Ventures Work in Real Estate

Joint ventures in real estate let investors work together, sharing resources and skills. This way, they can tackle projects that one person couldn’t do alone. They offer different financing options, where everyone brings money, credit, or know-how to the table. To make these partnerships work, it’s important to set up deals clearly, defining everyone’s role and how profits will be split.

Joint Venture Real Estate Financing Options

Getting the right financing is key to making a real estate joint venture work. Most big projects use crowdfunding or joint ventures, with an operating partner and a capital partner12. The operating partner knows the real estate world well and adds valuable insights. The capital partner provides the funds needed to get things done12. This team-up means more money and shared costs, making big dreams more achievable.

Structuring Joint Venture Real Estate Deals

Setting up joint venture deals the right way is crucial for success. You can use LLCs or partnerships, which offer protection and flexibility12. Important parts of the agreement include how profits are split, how much money each partner puts in, who makes decisions, and how to get out of the deal12. Picking the right partners with the right skills and goals is key to a successful partnership13.

Common Mistakes in Joint Venture Real Estate Deals

Joint ventures can be great, but they can also have problems if not planned well. Issues like unclear agreements, not checking things out enough, and not having the same goals can happen13. Not having full control can lead to disagreements and less equity if not sorted out13. Knowing these risks is important to protect your joint venture.

Legal Considerations for Joint Ventures

When you start a joint venture, knowing the legal stuff is key. Joint venture agreements and shareholders’ agreements set out each partner’s rights and duties. They cover what you’ll work on together and how you’ll make decisions and run things.

Joint Venture Agreements and Shareholders’ Agreements

Joint venture agreements talk about how long the project will last, what each partner will bring to the table, and how you’ll make decisions. Partners might share their skills, time, or money to help the venture succeed14. It’s important to be clear about who owns what and who makes what decisions. This helps avoid arguments and keeps everyone on the same page.

Tax Implications and Legal Protections

Getting the tax stuff right is crucial for a joint venture. Taxes can change a lot depending on where you are and can affect how much money you make. To protect everyone’s interests, you need to think about legal stuff like indemnities and keeping things secret. Joint ventures let businesses try new things for a bit, so it’s key to think about both legal and tax stuff carefully15.

| Aspect | Joint Venture Agreements | Shareholders’ Agreements |

|---|---|---|

| Purpose | Define collaboration terms and operational strategies | Outline ownership stakes and governance |

| Scope | Typically limited in duration and scope | Focus on long-term ownership and management |

| Tax Implications | Variable based on jurisdiction | May influence dividends and shareholder returns |

| Legal Protections | Indemnities, confidentiality clauses | Rights and obligations of shareholders |

In conclusion, dealing with the legal side of joint ventures is complex. You need to think about many things, from the agreements to taxes. Having the right legal setup can really help your business partnership do well and last1415.

Success Factors and Challenges in Joint Ventures

Joint ventures come with both chances and hurdles. To succeed, focus on trust, collaboration, careful planning, and managing risks well. These steps help overcome common problems and boost the chance of reaching goals.

Importance of Trust and Collaboration

Trust is key in joint ventures. Without it, issues can arise, threatening the partnership. By being open and transparent from the start, partners can work better together16. It’s also vital to make sure everyone’s goals align.

Evaluating Joint Venture Opportunities

Looking into joint ventures means checking if partners fit well and how resources are shared. A survey found over 80% of joint ventures did well or better than expected17. Choosing the right partner through careful checks reduces risks. Clear goals and strategies help align the venture with the company’s growth plans17.

Risk Management Strategies

Good risk management is crucial in joint ventures. Proper planning and enough resource commitment boost success chances16. It’s important to have good governance and check on progress regularly. Having clear ways to solve disputes and exit strategies helps avoid problems and makes working together smoother.

| Success Factors | Joint Venture Challenges |

|---|---|

| Trust and Collaboration | Misalignment of Goals |

| Effective Resource Allocation | Market Pressures |

| Comprehensive Due Diligence | Lack of Governance |

| Clear Objectives | Poor Planning |

By focusing on these key areas, you can make joint ventures work better1617.

Conclusion

Joint ventures are a great way for businesses to grow without the big risks of merging or buying other companies. They let companies share resources and knowledge to tackle market challenges and innovate. But, it’s important to know the risks and plan well.

It’s key to understand the legal side, how to manage risks, and how to work together well. Good governance is crucial for following the law and keeping a good name, which helps your partnership work well18. Also, being able to use the strengths of both partners, like getting special skills and working together better, can make you more competitive19.

To do well in a joint venture, make a clear plan that deals with possible problems, like how to make decisions together. Finding the right balance between working on your own and working together can lead to great results. By focusing on these things, you can build strong partnerships and enjoy the many benefits of working together.

Ready to take your real estate ventures to the next level ? Visit our Services page to learn how we can help you with expert real estate advisory and capital raising strategies. If you have any questions or need personalized guidance, don’t hesitate to reach out to us through our Contact page.

Looking to explore more? Check out our website for additional resources and insights!

FAQ

What is a joint venture?

A joint venture is when two or more companies work together under an agreement. They share resources, risks, and rewards to reach a common goal.

What are the benefits of establishing a joint venture?

Joint ventures offer shared resources and risk management. They give companies access to new markets and skills. This way, companies can innovate and grow without losing control.

What are the different types of joint ventures?

There are two main types of joint ventures. Business joint ventures are ongoing shared businesses. Project-based joint ventures focus on specific projects. They can be either unincorporated or incorporated.

How do joint ventures work in real estate?

In real estate, joint ventures help with raising capital and sharing risks in property development and management. They combine capital, set profit sharing, and decide together.

What legal considerations should be taken into account for joint ventures?

It’s key to have clear agreements on what the joint venture will do and how it will work. Shareholder agreements should cover ownership and decision-making. Tax and legal protections are also important.

What factors contribute to the success of a joint venture?

Success comes from trust and teamwork among partners. It’s important to match skills and cultures well. Strong risk management helps handle challenges.

What are common mistakes in joint venture real estate deals?

Mistakes include unclear agreements, not doing enough due diligence, and not aligning goals. These can harm the joint venture.

How can I find potential partners for a joint venture?

Look for partners through networking, industry events, and professional connections. Check if they match your skills, market, and culture for a good partnership.

How are profits distributed in a joint venture?

Profit sharing is set in the agreement. It outlines each partner’s share and how profits are split. This keeps partners happy.

What are the tax implications of joint venture investments?

Taxes can change based on where you are and affect the joint venture’s finances. It’s smart to talk to tax experts before starting a joint venture.